By WU LI

REFORM and innovation are two buzzwords defining contemporary China. Since China adopted the reform and opening-up policy 40 years ago, foreign companies have injected huge momentum to the Chinese economy, and benefited from the market’s fast growth.

Last October, in the report he delivered at the 19th National Congress of the Communist Party of China (CPC), General Secretary Xi Jinping stressed that China will make new ground in pursuing opening-up on all fronts. “China will not close its door to the world; we will only become more and more open,” he said.

China will, as Xi expounded in the report, implement the system of pre-establishment national treatment plus a negative list across the board, further open the service sector, and better protect the legitimate rights and interests of foreign investors. “All businesses registered in China will be treated equally,” Xi declared. His remarks signified greater opportunities for foreign investors.

Reform Invigorates Market

Dongguan, a city in Guangdong Province, is undergoing a fundamental transformation.

The city, also known as the “world’s factory,” thrived in the wake of reform and opening-up, as foreign capital poured in. This is why any wind of divestment in last few years would rouse clamors of comments in Dongguan.

Looking back, however, the city remained a hot spot for foreign funds by advancing industrial upgrading and restructuring. Cai Kang, head of the local commerce authority, said the once-dominant processing and manufacturing industries are transforming into high-end modern manufacturing.

It’s normal to see a flow of capital, in either direction, during periods of reform. Dongguan took the initiative to restructure industrial patterns and upgrade technologies, thus optimizing the utilization of foreign capital.

In the first half of 2017, the growth rate of foreign investment doubled in several towns, among which Shijie Town registered a rise of 506.3 percent. The most invested fields included R&D and design, telecommunication, trade and logistics, IT technology, smart phone chips, camera lenses, and basic parts for robotization.

Changes can be seen everywhere across China. In Shanghai, a metropolis on the eastern coast, a national-level pilot free trade zone (FTZ) was set up several years ago, where many foreign companies have settled. Decathlon, a French sports equipment retailer, unveiled its new Chinese headquarters, China Lab, in the FTZ on September 1, 2017. “We established China Lab to get closer to the Chinese market and provide better products to our customers,” said Wang Tingting, vice president of Decathlon in Greater China.

Decathlon first set up offices in China for procurement in 1992. As China’s sports and leisure market boomed, the number of its retailing outlets increased – in the last couple of years 50 stores were opened annually, making it visible in 100 Chinese cities. Decathlon plans to extend its presence to as many as 200 cities, said Wang. China has become more important in the transnational company’s business landscape – from a source of raw materials, a production base, a retail market, to a R&D center.

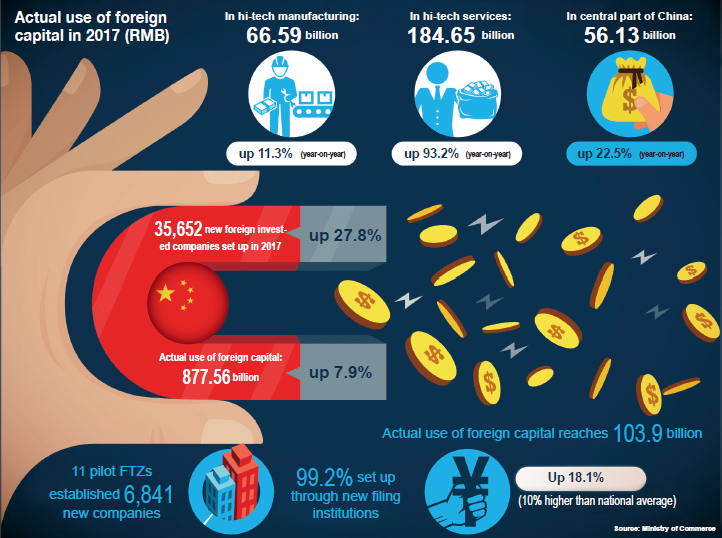

According to the Ministry of Commerce, in the last five years, the scale of foreign investment in China has been at the forefront of the world, which has exerted a positive influence on the Chinese economy and society. At the same time, the pace of industrial upgrading has been expedited. In the first three quarters of 2017, the investment in hi-tech manufacturing and hi-tech services rose by 27.5 percent and 24 percent respectively over the same period of 2016; and the investment to central China spiked by 46 percent.

Zhang Yansheng, chief researcher with the China Center for International Economic Exchanges, said that as profound changes and adjustments continue in China and the world at large, China needs to forge new advantages through reform and innovation.

Shrewd investors will adapt themselves to this development, but not bid farewell to a vibrant market.

Institutional Advantages

A more open China is expected as the spirit of reform and innovation is embraced.

At the BRICS Xiamen Summit in September 2017, attending heads of state approved a host of outcome documents, including the Outlines for BRICS Investment Facilitation, the first of its kind in the world. One year earlier, at the G20 Hangzhou Summit, the G20 Guiding Principles for Global Investment Policymaking was adopted. It was the first multilateral investment framework to be established.

China has long participated in global economic governance, business, and trade rule-making. It believes that effective institutions and systems are needed to contain the rise of protectionism, and become an anchor amid increasing uncertainties. In the past two years, China began to play a leading role in promoting free investment worldwide, as exemplified by the aforementioned documents. Why? The answer lies in the nation’s keen sense of responsibility and confidence, and moreover, in its reform and innovative activities under the guidance of Xi’s thinking on national governance.

In 2012, Xi put forward the idea of building an open world economy at the 18th CPC National Congress. He declared to kick off a new round of high-quality opening-up and establish new institutions of open economy, thus making the nation not only a participant but also torchbearer in the rule-making for international business, trade, and governance.

In recent years, the Ministry of Commerce has been soliciting foreign investment through multiple ways. First, it expanded the scope of opening-up by slashing restrictions while increasing the number of priority industries for foreign investment by 228.

Second, it reformed the foreign investment management in a bid to facilitate investment. Except for sectors under special management, the filing system has been applied to the establishment and alternation of foreign companies, putting an end to the 30-plus-year-old examination and approval system.

Third, the ministry promotes the establishment of pilot FTZs across the country. During the operation of the current 11 FTZs, a wealth of experience in institutional innovation has been accumulated in such fields as trade, investment, finance, and supervision. Now a total of 123 matters of practice are promoted nationwide.

Last but not least, China accelerates the upgrading of national-level development zones. The General Office of the State Council issued two policy documents in recent years, which defined the orientation and functions of the national-level development zones in the new era – to be the powerhouse of national economy, propeller of opening-up, and test ground of institutional reforms. Meanwhile, progress has been made in border economic cooperation zones and other platforms of transnational cooperation.

Seizing a Historic Opportunity

Microsoft China is headquartered in the center of Zhongguancun, or China’s Silicon Valley, in Beijing. Though entering the Chinese market 25 years ago, the IT giant still calls itself a start-up. In the wake of a new tech tide, Microsoft China is constantly transforming itself, exploring fresh domains such as cloud computing, big data, Internet of Things, and AI.

Alain Crozier is the corporate vice president, chairman, and chief executive officer of Microsoft Greater China Region. He believes the new industrial revolution, represented by a digital economy, would bring unprecedented opportunities to all industries in China and across the globe. With the advent of digital time, he said, Microsoft is speeding up the building of a vibrant ecology with its partners and cooperators.

In fact, opportunities never vanish wherein cooperation exists. For example, since China opened its huge market to the world four decades ago, foreign investors have obtained substantial returns in China, while the country has made great progress and formed its own way of development. Recently, however, as the world economy remains sluggish and China enters the “new normal” stage, whether China still needs foreign capital is under debate.

In such context, President Xi stressed on several occasions that three matters will not be changed – implementing policies on utilizing foreign investment, safeguarding foreign investors’ legitimate rights and interests, and offering better services for foreign companies. Opening up is our fundamental policy, he reiterated, China will not close its door to the world.

Why does Xi attach such great importance to foreign capital? According to Zhao Jinping, director of the Research Department of Foreign Economic Relations with the Development Research Center of the State Council, the answer lies in the significant role that foreign companies play in many aspects, from industrial chains to legal institutions. Over the last four decades, Zhao said, Chinese-foreign equity joint ventures, Chinese-foreign contractual joint ventures, and wholly foreign-owned enterprises have become indispensable market players in China. They create jobs, pay taxes, and boost export and import. Their R&D and hi-tech input injects energy to innovative activities in China, contributing to Chinese economic restructuring and supply-side structural reform.

As the new era approaches, foreign companies also spot new opportunities. Over the last few years, Shanghai-based SAIC General Motors made a foray into emerging businesses. Executive Vice President Julian Blissett said SAIC General Motors has achieved fast development in such fields as auto finance and car renting.

David Manke, vice president of United Technologies Corporation, told Xinhua News Agency that the company associated its long-term goals with urbanization, rise of the middle class, and air transportation, all of which are under fast development in China. Manke said that, given its status in these fields, China is crucial to the UTC’s future.

Matthew Crabbe, director of Research of Asia-Pacific at Mintel Group, expressed strong interest in China’s vowing to develop service trade. He forecasted that the consumption trends in China have upgraded, featuring more varieties, higher quality, and better convenience, which will steadily spur greater consumption. In the next five years, the country is expected to maintain a positive momentum in consumptive products and service market, especially in the tourism sector.

The latest statistics from the Ministry of Commerce show that in the first 11 months of 2017, the actual use of foreign capital increased by 9.8 percent year-on-year; and the amount of actual used foreign capital in November reached RMB 124.92 billion, up 90.7 percent over the same month a year earlier.

Exciting Future Ahead

In September 2017, Deloitte celebrated its 100th anniversary of entering the Chinese market, and announced a strategic investment of US $200 million to strengthen training and capacity building in light of future development.

“In the last 100 years, Deloitte witnessed the great changes that have occurred in China’s investment environment,” said Vivian Jiang, deputy CEO of Deloitte China. Especially over the last few years, she added, the investment environment, soft or hard, is getting better. Deloitte shows confidence in the Chinese market, as the economic upgrading has sped up, and the country is getting closer with the world under the framework of the Belt and Road Initiative.

Confidence is rooted in the full understanding and reasonable judgment of the market. In a survey conducted by the American Chamber of Commerce in Shanghai, 77 percent of interviewed American companies profited in China in 2016. The data by The European Union Chamber of Commerce in China revealed that in 2016, 71 percent of company participants have generated as much pretax profit as that of 2011, the best year in history, and more than half of the companies planned to expand their China operations.

Long Guoqiang, vice director of the Development Research Center of the State Council, believed China remains one of the most attractive destinations for investment. The reasons, he said, lie in five aspects – unleashed demands from consumers, a complete industrial supportive system and infrastructure, substantial reserves of human resources, stable economic and social environment, and more opening-up, institutional reforms, and innovation. Foreign companies need to adapt to changes in the market, Long suggested, instead of lamenting on the exit of preferential policies, or the fading of one-time advantages.

In recent years, the State Council has issued two documents facilitating the entry of foreign investment – Notice on Expanding Opening-up and Proactively Utilizing Foreign Capital, and Notice on Measures of Facilitating Foreign Investment Growth. To facilitate the implementation, the Department of Foreign Investment Administration of the Ministry of Commerce accelerated the reform in foreign capital management and services, expand pilot FTZs, and improve the environment for investment.

Similar to China’s industrial upgrading, the American government launched Select USA program, and Southeast Asian countries ratcheted up efforts in soliciting investment. Experts believe that China needs to avoid the exodus of businesses while accelerating overall industrial planning. In East China, for example, the market and policy environment is mature for developing hi-tech manufacturing and modern services; while West China should further reform and open up, and improve infrastructures to accommodate industries moving from the East.

In addition to enormous economic size, huge purchasing power, and upgraded consumption, China’s institutional innovation and optimized business environment will attract forward-looking investors.

For now, socialism with Chinese characteristics has entered a new era, ushering in a more open, fairer, and more convenient market. Foreign investors are expected to grow with the maturing market, carrying on the success stories that have been written in the past.

WU LI is a reporter with International Business Daily.