ON March 15, the Second Session of the 13th National People’s Congress (NPC) reviewed and approved the high-profile Foreign Investment Law. Leading up to the approval, Wang Chen, vice chairman of the NPC Standing Committee, pointed out in his explanation of the Foreign Investment Law (Draft) that foreign investment legislation follows and reflects four important principles: highlighting the main theme of actively expanding opening-up and promoting foreign investment, adhering to the positioning of the foreign investment law as a fundamental law, adhering to the integration of Chinese characteristics and international regulations, and adhering to the accordance of domestic and foreign investment.

Deputies vote during the closing meeting of the Second Session of the 13th National People’s Congress (NPC) at the Great Hall of the People in Beijing on March 15, 2019.

Zhang Yuyan, a member of the National Committee of the Chinese People’s Political Consultative Conference (CPPCC) and director of the Institute of World Economics and Politics of the Chinese Academy of Social Sciences, believes that as global trade protectionism gains a stronger foothold, China, as a responsible power, has firmly expressed its position and determination to maintain economic globalization. This will be done by formulating the Foreign Investment Law to encourage free flow of cross-border capital and support trade liberalization.

Why Should a New Law Be Formulated ?

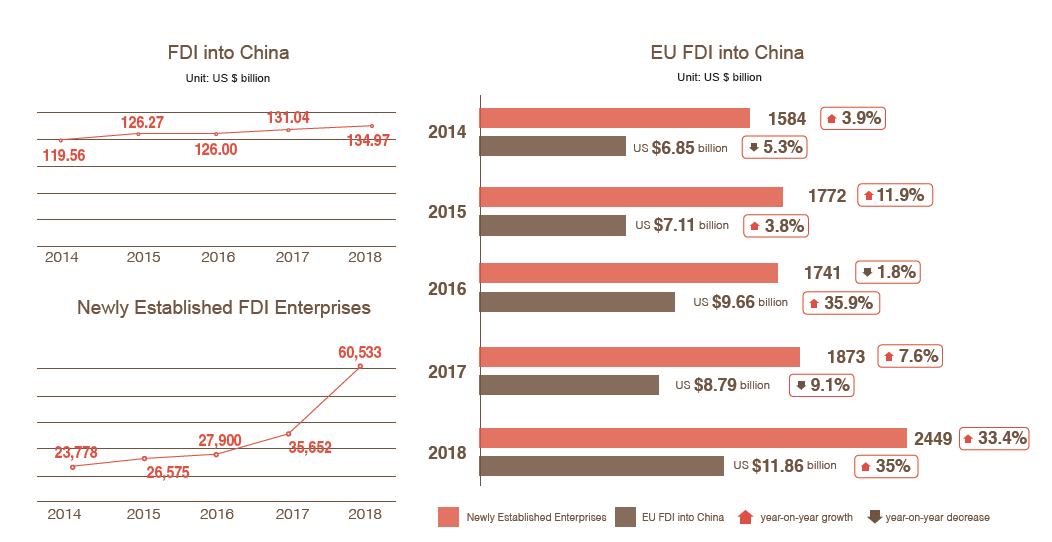

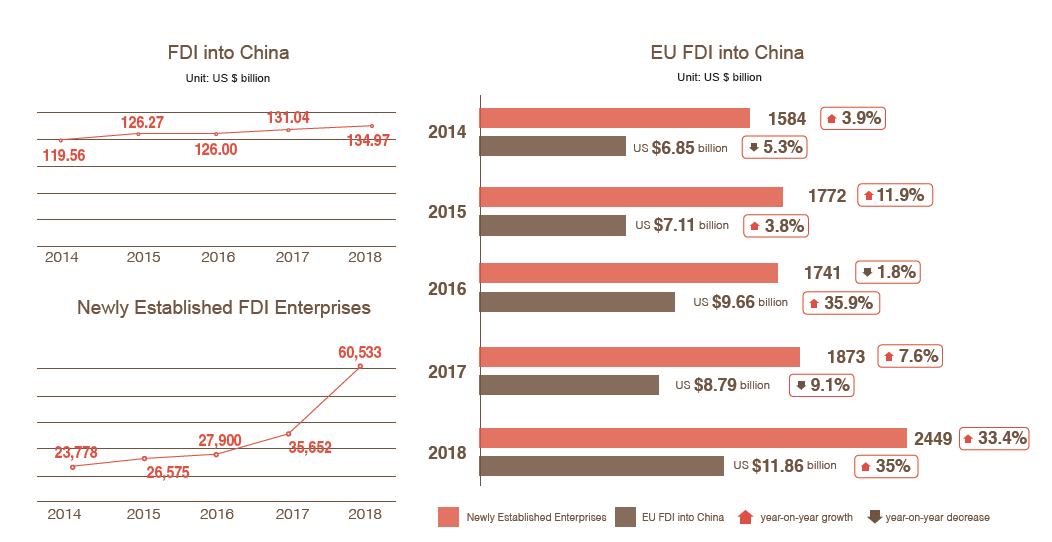

Since the reform and opening-up kicked off in 1978, China has attracted a great deal of foreign investment. By the end of 2018, a total of 960,000 foreign-invested enterprises were set up in China, with the cumulative actual use of foreign capital exceeding US $2.1 trillion. From a set of figures, it is easier to understand the radical changes in the scale of China’s use of foreign capital: In 1983, China actually used foreign direct investment of US $920 million. By 2018, this figure increased to US $134.97 billion, 147 times that of 1983.

Not only has there been a sharp increase in the amount of foreign investment, but also the domestic and international economic environment that China is facing has undergone tremendous changes compared with the initial stage of its reform and opening-up. Therefore, the three foreign investment enterprise laws (the law on joint Chinese and foreign investment enterprises, the law on foreign-funded enterprises, and the law on Chinese-foreign contractual joint venture, collectively referred to as the “three foreign investment laws”), which were promulgated at the initial stage of reform and opening-up, have become difficult to adapt to the new situation facing China’s opening-up and utilization of foreign capital, and the need for China to build a new open economic system.

China’s national legislature on March 15, 2019 adopts the Foreign Investment Law at the closing meeting of the Second Session of the 13th National People’s Congress. The law will become effective on January 1, 2020.

Zhang said the unveiling of the Foreign Investment Law is of great necessity and that foreign capital, especially technology-intensive foreign investment, will play an important role in promoting China’s economic growth in the long run. Therefore, China needs to give foreign merchants a favorable legal environment, which is also very important for cultivating international economic cooperation and implementing all-round opening-up. “The law plays an important role in reducing uncertainty and transaction costs, and serves as a response to some international concerns, such as policy transparency, intellectual property protection, and a level playing field,” said Zhang.

Why Now?

On December 23, 2018, the Foreign Investment Law (Draft) was submitted to the NPC Standing Committee for deliberation. On January 29, 2019, the Standing Committee conducted a second review of the draft. On March 15, the law was officially introduced.

Some people believe that not enough time was spent on the deliberation of the law, and the process of introduction was too hasty. But is this the truth?

In fact, after years of internal research, as early as the beginning of 2015, the Ministry of Commerce solicited public opinion on the Foreign Investment Law (Draft) for the first time. However, due to the immature condition of the integration of the “three foreign investment laws” into one, it was not until March 4, 2018 that the law was mentioned again at a press conference to introduce legislative projects in 2018 during the First Session of the 13th National People’s Congress.

The new law is more concise than the 2015 version. The implementation of the pre-establishment national treatment plus the negative list management system is more clear and thorough, reflecting the requirements of a higher level of investment liberalization and facilitation.

According to Duan Xiaoying, senior vice president of General Electric (GE), GE had the honor of participating in the discussion process of the draft law in recent years. “The law clearly stipulates that foreign investment in China shall be subject to pre-establishment national treatment plus the negative list management system. On the issue of national treatment and intellectual property protection that foreign-invested enterprises are most concerned about, there are statements based on transparency, predictability, and fairness, including that overseas-funded enterprises can participate in the standardization work and government procurement on an equal footing,” said Duan, adding that a unified Foreign Investment Law represents a crucial step for China to move toward deeper institutional opening-up.

What Are the Concerns the Law Will Deal with?

Equal enjoyment of government support policies, equal participation in standardization work, fair participation in government procurement, and the same financing facilitation as domestic enterprises – these are the current demands of overseas-funded companies in China, and now the introduction of the Foreign Investment Law is giving them much needed reassurance. The legislative protection of fairness after admission will enhance the attractiveness of the Chinese market to foreign investment.

In addition, “compulsory technology transfer” is also a concern for some foreign investors to China. In fact, China clearly stated in its Accession Protocol to the WTO that China does not approve foreign investment on the premise of technology transfer requirements. In the trade agreements signed by China and related parties, China also made corresponding commitments and has fulfilled those commitments. In the Foreign Investment Law, it is further clarified that “the administrative organs and their staff members must not use administrative means to force the transfer of technology,” which will thoroughly eliminate investor concerns.

After three years of piloting in the Free Trade Zone, China abolished the approval system for the establishment and change of foreign-funded enterprises nationwide at the end of 2016, and only the fields on the negative list are subject to the approval procedure. On the foreign side, there is no need to worry about the pressure to transfer technology during the approval process. The law confirms that the business approval and filing procedures for the establishment and change of foreign-invested enterprises will be cancelled.

In addition to investment promotion and protection, the law also clearly provides preferential measures for foreign investors, government commitments, negative list of foreign investment access, related access systems, foreign investment information reporting systems, and security review systems to fundamentally protect the rights and interests of investors.

Toward Institutional Openness

According to the Global Investment Trends Monitor released by the United Nations Conference on Trade and Development, foreign direct investment in countries around the world dropped by 19 percent in 2018. However, the volume China had attracted during the same period increased against the trend. According to data released by the Ministry of Commerce, China’s actual use of foreign capital reached a record high in 2018, and the newly established foreign-invested enterprises nationwide increased by 69.8 percent year-on-year.

According to Zhou Xuezhi, assistant research fellow at the Institute of World Economics and Politics under the Chinese Academy of Social Sciences, the introduction of the law means that China has taken substantial steps toward institutional openness. The law clearly stipulates that foreign investment in China is subject to the pre-establishment national treatment plus negative list management system. “This is the current popular practice in the world, reflecting China’s willingness to integrate with international models in attracting foreign investment. It also highlights China’s determination to continue to expand its openness and promote openness,” said Zhou.

According to Yao Ling, deputy director of the Department of European Studies at the Chinese Academy of International Trade and Economic Cooperation of the Ministry of Commerce, the introduction of the law further demonstrates China’s determination to unswervingly expand its opening-up and deepen reforms. It reflects China’s consistent position and practical actions in support of trade and investment liberalization and facilitation, and is also conducive to foreign investors’ confidence and long-term planning for the Chinese market.

Unswervingly Improving the Business Environment

At the end of October 2018, the World Bank released the Doing Business 2019. China ranked 46th in the ease of doing business category, making it to the top 50 for the first time. The country also became one of the top 10 most significant economies in the business environment improvement category.

In 2018, China issued two documents to promote foreign investment in the country, the Measures for Actively Using Foreign Capital to Open Wider to the Outside World in January and Measures to Promote Foreign Investment Growth in August. “The introduction of two important policy documents within one year is rare in history,” said Ning Jizhe, deputy director of the National Development and Reform Commission. A total of more than 40 specific policy measures have been released to expand opening-up, create a level playing field, and strengthen investment promotion. In addition, China revised the Guidance Catalogue for Foreign Investment Industries in 2015 and 2017, and reduced the restricted fields of access to foreign investment by 65 percent.

China’s initiatives to promote foreign investment have also received positive feedback from foreign companies. According to the 2019 China Business Climate Survey Report released by the American Chamber of Commerce in China (AmCham China) on February 26, 2019, 62 percent of member companies regard China as the top priority of their recent global investment plans, and 50 percent of members believe that China will take measures to further open the market to foreign companies. “Bright prospects for domestic consumption and a gradually improved investment environment have helped China remain a top investment destination globally,” said Tim Stratford, chairman of AmCham China.

While paying attention to the contents of the law, potential foreign investors are also paying special attention to the details of how the law will be implemented after its adoption. “How to implement the law after the adoption, how to remedy problems when they occur, how to make an administrative appeal, or how to go to law are all extremely important to foreign-funded enterprises,” said French Ambassador to China Jean-Maurice Ripert. When the AmCham China was invited to give suggestions for the draft law, its member companies also hoped to formulate detailed rules and regulations as soon as possible at the operational level.

“To regulate others is to regulate oneself. Establishing a system-based and rule-based investment environment is a vital part of a high-level opening-up,” said Zhang.